XRP Price Prediction: Navigating Short-Term Weakness Amid Long-Term Growth Fundamentals

#XRP

- Technical analysis shows XRP trading below key moving averages with critical support at $2.14

- Ripple's $1 billion treasury accumulation and corporate expansion signal long-term confidence

- Mixed market sentiment balances fundamental strength against technical weakness

XRP Price Prediction

XRP Technical Analysis: Navigating Key Support Levels

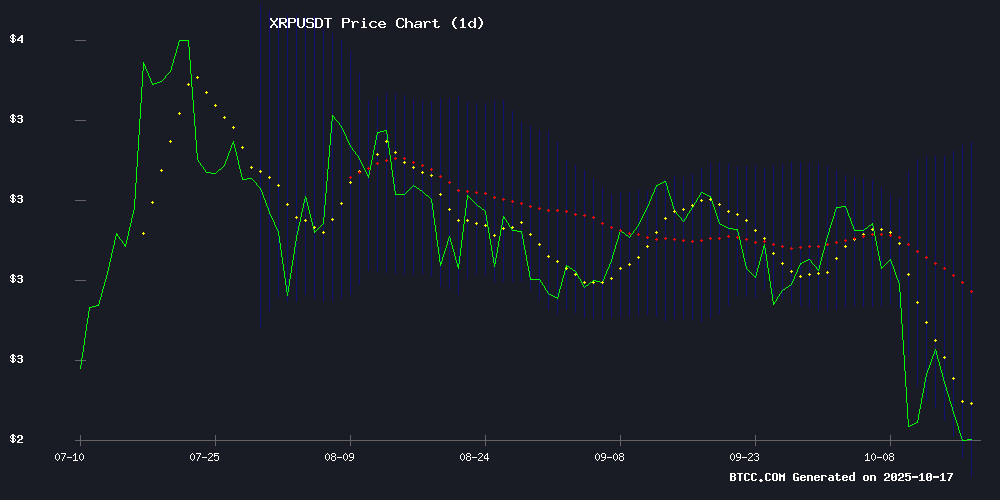

XRP currently trades at $2.3215, below its 20-day moving average of $2.7266, indicating short-term bearish pressure. According to BTCC financial analyst James, 'The MACD reading of 0.2373 versus the signal line at 0.1229 shows bullish momentum remains, though the death cross formation warrants caution. The Bollinger Band positioning between $2.2155 and $3.2377 suggests the $2.14 support level is critical for maintaining the current trading range.'

Mixed Signals: Ripple's Strategic Moves Versus Market Sentiment

BTCC financial analyst James notes that 'Ripple's $1 billion treasury accumulation and GTreasury acquisition demonstrate strong corporate confidence, yet market reaction remains muted. The expansion into corporate treasury markets and global stablecoin adoption priorities provide fundamental support, but current price action reflects broader market weakness and technical headwinds.'

Factors Influencing XRP's Price

XRP Price Prediction: Death Cross Signals Potential Downtrend Amid Market Weakness

XRP's price trajectory has turned fragile as a death cross formation between its 10-day and 50-day moving averages triggers bearish sentiment. The cryptocurrency now faces critical support tests at $1.93, with analysts eyeing a potential breakdown toward $1.75 if selling pressure persists.

Technical charts reveal a descending triangle pattern—a classic bearish continuation setup—as XRP trades near $2.27, marking a 5.5% daily decline. Market observers note the $1.83 level as crucial support, with a long-term floor at $0.78 that could come into play if the downturn accelerates.

The weakness mirrors broader crypto market conditions, where fading momentum across major assets has increased volatility. Traders are monitoring whether this technical breakdown will deepen or establish a base for future recovery.

Ripple's $1 Billion XRP Treasury Plan Signals Long-Term Confidence

Ripple is launching a $1 billion digital-asset treasury (DAT) to accumulate and manage XRP as a strategic reserve, according to a Bloomberg report. The initiative, financed through a Special Purpose Acquisition Company (SPAC), would create a permanent buyer for the token, stabilizing its market presence.

The treasury will be seeded with part of Ripple's 4.7 billion liquid XRP holdings, valued at nearly $11 billion. This move underscores corporate confidence in the ecosystem while leveraging Ripple's existing escrow system, which releases one billion XRP monthly with 60% typically re-locked to control supply.

Ripple's relationship with XRP remains distinct—the private company develops payment solutions using XRP and Ripple USD (RLUSD), while holding 42% of the token's 100 billion total supply. The DAT experiment could redefine institutional engagement with crypto reserves.

Ripple Partnerships Drive XRP Adoption and Global Expansion

XRP is undergoing a transformative phase, fueled by institutional accumulation and strategic partnerships. Once considered stagnant, the token is now emerging as a bridge between traditional finance and blockchain infrastructure. Japan's SBI Holdings and other financial institutions now collectively hold over $11 billion in XRP, signaling a shift from speculation to practical utility.

Ripple's network offers transaction settlements in seconds at a fraction of the cost of traditional systems like SWIFT. This efficiency is driving adoption among banks and corporates for treasury management and cross-border liquidity. Analysts see this institutional embrace as validation of XRP's long-term role in global finance.

Strategic expansions in the Middle East and other regions seeking modernized payment infrastructure further underscore Ripple's growing influence. The combination of regulatory progress and real-world use cases positions XRP as a competitive solution in the evolving financial landscape.

Ripple Labs Plans $1 Billion XRP Accumulation Despite $30 Billion Escrow Holdings

Ripple Labs is preparing to raise at least $1 billion to acquire additional XRP, the digital asset underpinning its global payment network. The move, potentially executed via a special purpose acquisition company (SPAC), represents one of Ripple's most substantial commitments to bolstering ecosystem liquidity and market confidence.

The funds will flow into a digital asset treasury (DAT) designed for strategic XRP deployment. Ripple may contribute existing holdings to this reserve, signaling a deliberate effort to create upward demand pressure. The initiative comes despite Ripple's existing access to 500 million XRP monthly from its 30 billion escrow balance.

Market analysts interpret this aggressive accumulation strategy as a play to demonstrate institutional conviction in XRP's long-term utility. By creating artificial scarcity through open-market purchases, Ripple appears to be engineering favorable supply dynamics while reinforcing its stake in the asset's success.

Ripple Expands Into Corporate Treasury Market With $1 Billion GTreasury Acquisition

Ripple is making a strategic leap into corporate finance with its $1 billion purchase of GTreasury, a global leader in treasury management systems. This acquisition positions Ripple squarely in the multi-trillion-dollar corporate treasury market, offering access to top-tier enterprises and expanding its influence beyond cross-border payments.

CEO Brad Garlinghouse emphasized the synergy between Ripple's blockchain technology and GTreasury's expertise, highlighting the potential to revolutionize how CFOs handle stablecoins and tokenized deposits. The deal underscores payments as the most viable blockchain application, aligning with Ripple's growing role in financial infrastructure.

Ripple's $1B GTreasury Acquisition Paves Way for RLUSD Corporate Adoption

Ripple's strategic $1 billion purchase of treasury management platform GTreasury marks a watershed moment for institutional cryptocurrency adoption. The deal creates a direct conduit for Ripple USD (RLUSD) to enter Fortune 500 treasury operations, challenging traditional stablecoin distribution models.

Despite RLUSD's 987% growth since launch, its $839.9 million supply represents just 0.27% of the $301.9 billion stablecoin market. GTreasury's existing integration with thousands of corporate cash management systems provides immediate access to treasury managers overseeing trillions in short-term assets.

The acquisition transforms RLUSD from an exchange-focused token into enterprise financial infrastructure. Corporate treasurers gain 24/7 balance sweeping, instant settlement, and repo market access without back-office overhauls - addressing the critical need for yield optimization on idle corporate capital.

Ripple CEO Clarifies XRP's Decentralized Nature Amid Legal Battles

Ripple CEO Brad Garlinghouse took the stage at D.C. Fintech Week to dispel persistent myths about XRP's governance. "People conflate Ripple with XRP," he noted, drawing a sharp distinction between the corporate entity and the decentralized ledger. "Ripple has a CEO—me. XRP has hundreds of builders."

The XRP Ledger ecosystem now spans developers, startups, and financial institutions independently expanding its use cases. This growth comes despite regulatory headwinds—Ripple spent $150 million defending against SEC claims that XRP constituted a security. The landmark case established precedent for open-source blockchain projects navigating U.S. regulations.

XRP Price Slips Despite Ripple Acquisition, $2.14 Support in Focus

Ripple's $1 billion acquisition of GTreasury failed to buoy XRP's price, with the asset dropping 5.6% in a single day. Market cap contracted by 5.75% to $137.21 billion, while intraday volumes reached $7.58 billion. The breakdown below the critical $2.47 support level has pushed XRP into a $2.27 zone, with oversold RSI and bearish MACD signaling further downside risk.

Repeated attempts to reclaim $2.47 have faltered, leaving $2.14 as the next likely support. Until XRP decisively breaks above $2.47, short-term rallies remain unlikely. The market's reaction underscores the disconnect between corporate developments and token performance, a recurring theme in crypto markets.

Ripple Outlines Five Key Priorities for Global Stablecoin Adoption

Ripple has identified regulatory alignment as the pivotal challenge for stablecoins to achieve borderless functionality. The blockchain firm's latest report, developed with Global Digital Finance, frames interoperability and trust as equally critical to mainstream adoption.

Japan's collaboration between Ripple and SBI Holdings demonstrates tangible progress in compliant integration. Stablecoins are increasingly recognized beyond crypto markets—now facilitating cross-border settlements where traditional finance falters.

The analysis synthesizes input from multinational regulators, emphasizing five core requirements: standardized oversight, technological compatibility, issuer accountability, transactional transparency, and multi-jurisdictional cooperation. This blueprint arrives as stablecoins evolve from speculative assets to pragmatic financial instruments.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a mixed investment case. The technical indicators show short-term pressure with the price below the 20-day MA and death cross formation, while fundamental developments from Ripple provide long-term optimism.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $2.3215 | Below 20-day MA |

| 20-day MA | $2.7266 | Resistance level |

| MACD | 0.2373 | Bullish momentum |

| Bollinger Lower | $2.2155 | Key support |

BTCC financial analyst James suggests 'Investors should monitor the $2.14 support level closely. Ripple's strategic acquisitions and treasury plans provide fundamental strength, but technical indicators suggest waiting for clearer bullish confirmation before significant position building.'